March Map of the Month

By Laura Diaz-Villaquiran

Source: Federal Insurance Office, U.S. Department of Treasury.

Home insurance costs are rising across the Southeast, threatening housing affordability for homeowners and renters alike. With the frequency and severity of climate-related disasters increasing, insurers are passing higher costs onto policyholders. Between 2018 and 2022, home insurance premiums written by the top 10 insurers in the region surged from $9.4 billion to $14.3 billion. Florida and Louisiana have been hit particularly hard and have some of the highest premium increases and non-renewal rates in the country.

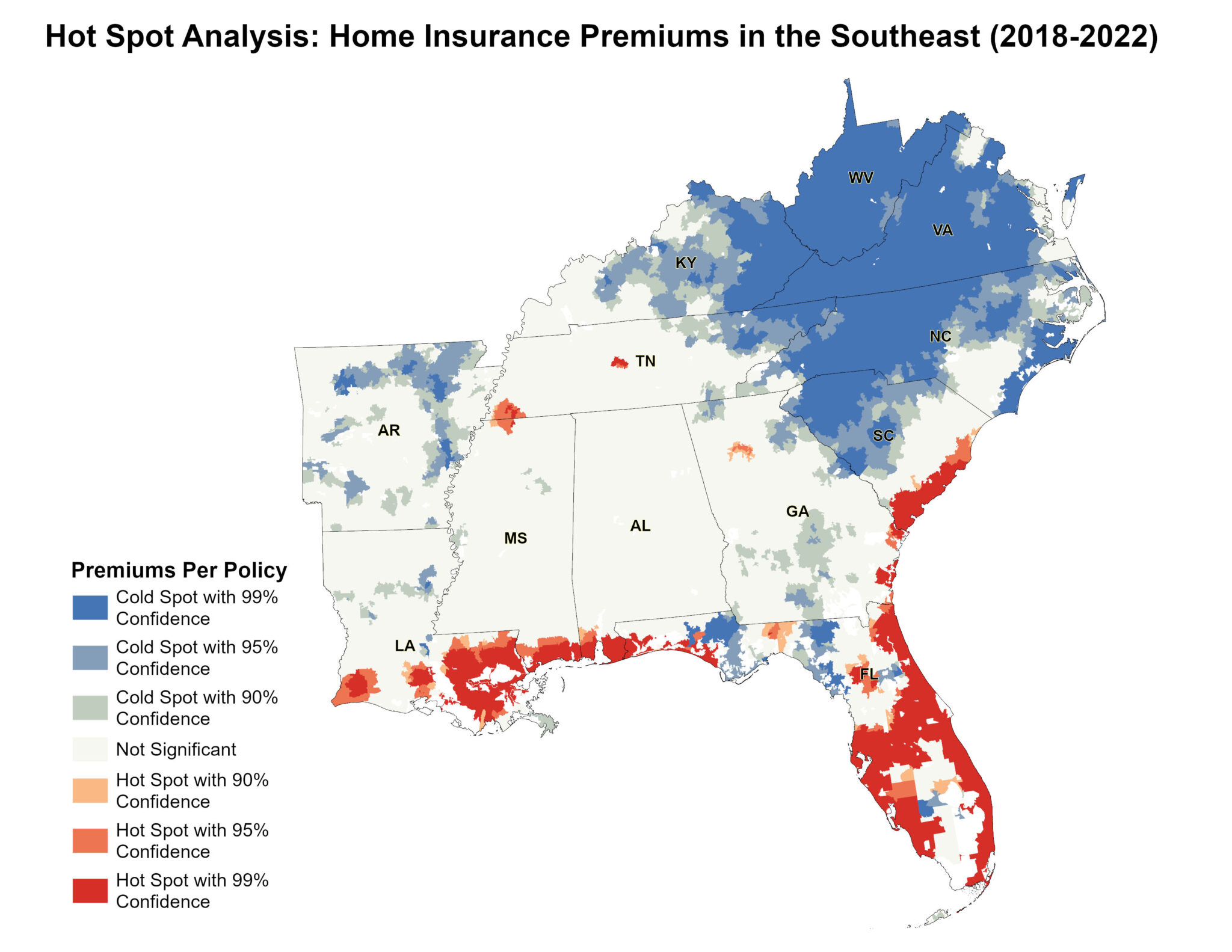

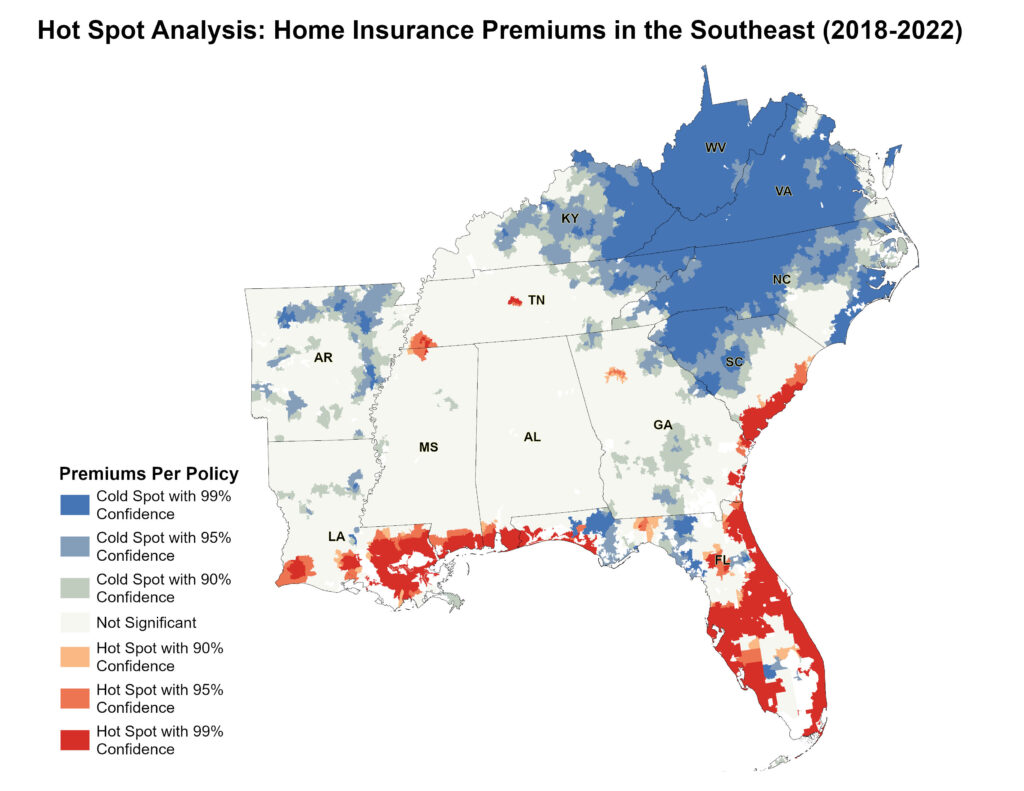

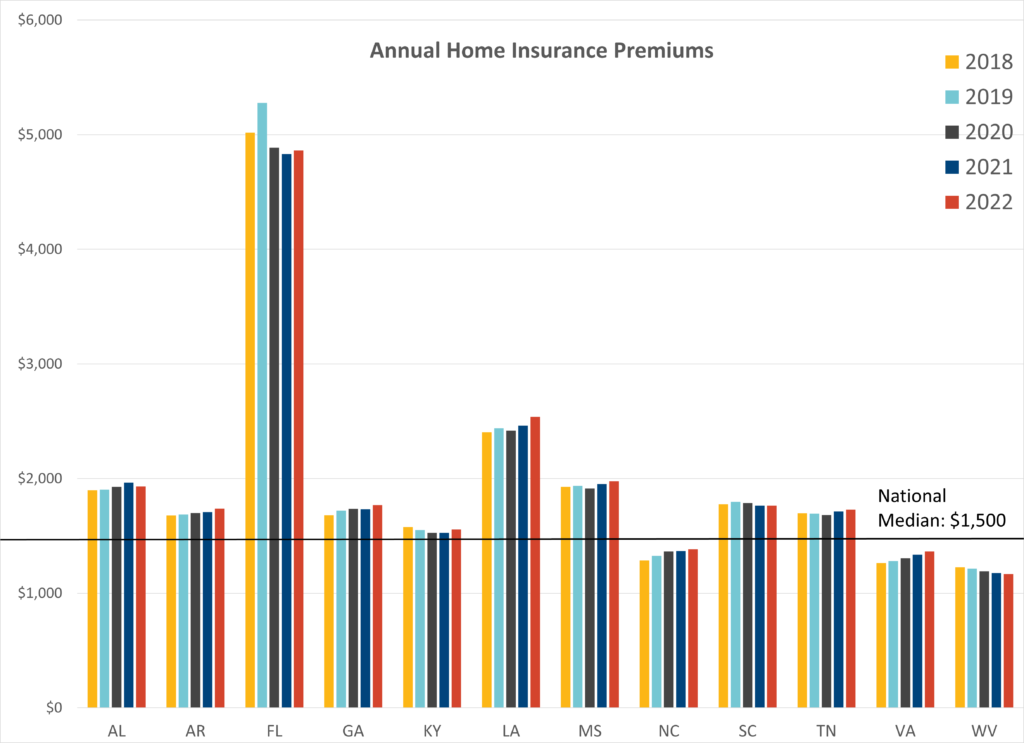

Using data from the same period provided by the U.S. Department of the Treasury, this month’s map highlights spatial patterns of home insurance costs across the Southeast through a geographic hot spot analysis. This dataset consists of comprehensive home insurance policies, which make up 85% of the home insurance market in the U.S. A hot spot analysis is a geospatial method used to detect statistically significant clusters of high or low values compared to surrounding regions. Insurance rates are calculated based on location, home value, and risk exposure. Nationally the median cost of home insurance was $1,500, while the average premium for that same period was $1,900. For the Southeast, the median premium was $1,600. See the recent average annual home insurance premiums for Southeastern states below:

This month’s map highlights areas where insurance premiums are high and cluster with other high values, with 99% confidence. Hot spots are concentrated along the Gulf and Atlantic coasts, while areas with lower premiums, also with 99% confidence, are primarily found further inland and north, in states like Kentucky, Virginia, West Virginia, and western North Carolina. In climate-vulnerable states like Florida, where extreme weather events have led to frequent insurance payouts, insurers have hiked premiums to remain solvent.

Beyond rising premiums, home insurance availability is shrinking as insurers withdraw from high-risk areas. Between 2018 and 2022, the average non-renewal rate in the Southeast (1.43%) was 38% higher than the national average (1.04%). This trend accelerated in 2023, with North Carolina and South Carolina experiencing sharp increases in non-renewals. Florida had the highest share of non-renewals, with insurers citing hurricane-related losses as the primary reason for exiting the market.

For homeowners, insurance is a necessity. Lenders require coverage to secure mortgages, and without it, banks can foreclose on homes. For renters, rising insurance costs can translate to higher rents, as landlords pass increased premiums onto tenants.

A 2025 First Street report found that in many Southeastern cities, insurance costs are outpacing home price growth. Traditionally, the region offered lower housing costs, but the risk of extreme weather has pushed insurance from 8% of mortgage payments in 2013 to more than 20% by 2022. Homeowners in Miami (322%), Jacksonville (226%), Tampa (213%), and New Orleans (196%) have seen the steepest premium increases in the region.

As the Southeast braces for the impact of rising sea levels, extreme heat, and increasing hurricane activity, planning for resilience is more critical than ever. Mitigation strategies will play an essential role in ensuring long-term housing is affordable and resilient. Improving residential energy efficiency can play a role in enhancing the resilience of housing during extreme weather and improving housing affordability to offset premium increases. Strengthening building codes, expanding access to energy efficiency, and investing in resilient infrastructure will be key in offsetting rising insurance costs and protecting homeowners and renters across the region.